https://www.equities.com/n…/19-in-19-is-the-09-bull-run-done

History of the ’09 Bull Market

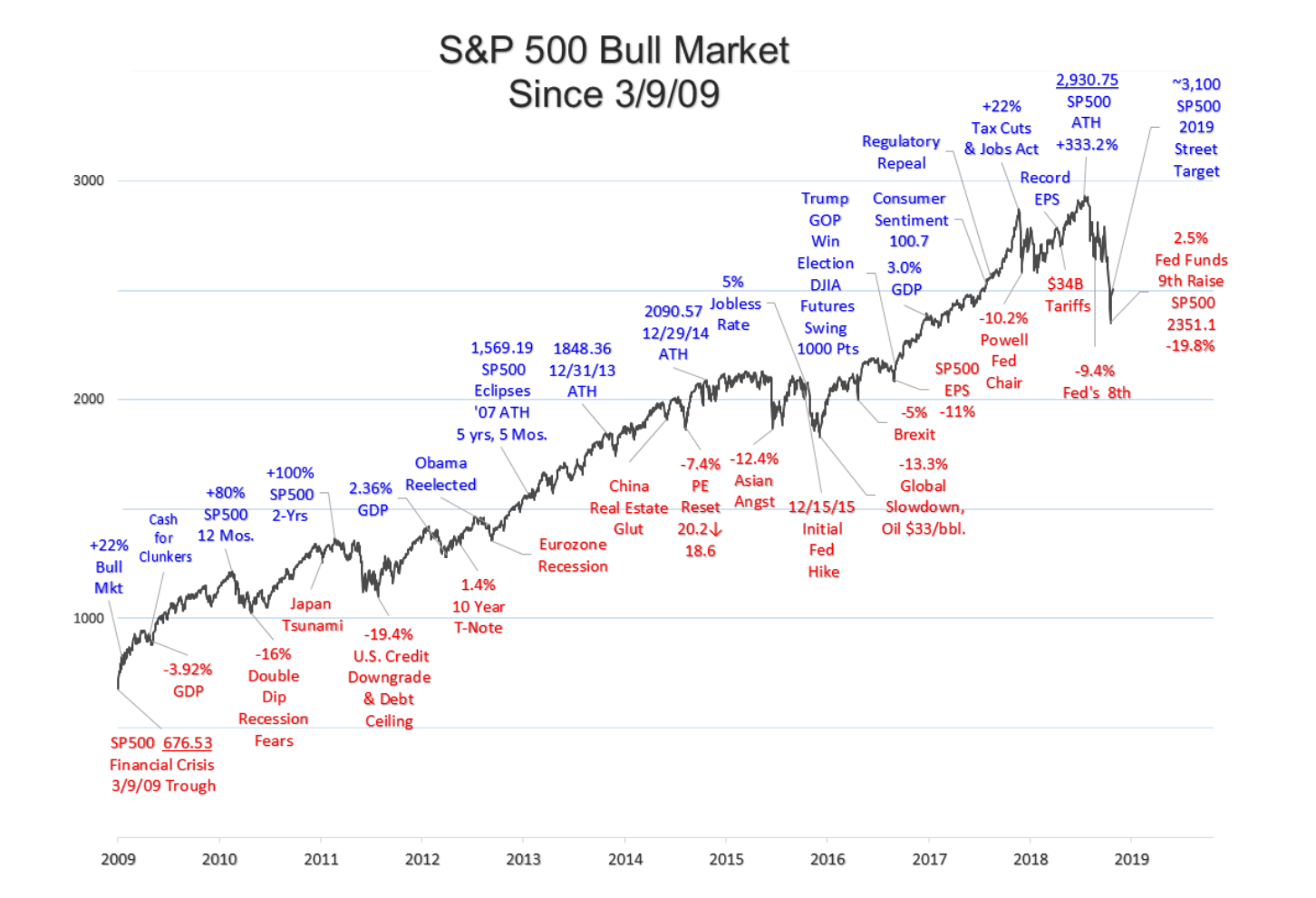

The secular bull market officially began on March 9, 2009, at 676.53 for the Standard & Poor’s 500 (SP500), the low point close of the horrendous ’08-’09 Great Recession. The stock market suffered its worst bear market since the 1930s; after peaking at 1,565.15 on October 9, 2007, the SP500 shed 888 points, erasing 56.7% of its value in 517 days. At the turn of the millennium, the index stood at 1,469.25; nearly a decade later, the index price was 54% lower. Owning stocks proved to be a costly and very painful exercise for investors during this period. Tuesday, March 10, 2009, the tide turned with the index increasing 6% on the trading session. The index rose 27% over the next 30 days and closed 66.8% higher at year’s end. Stock prices were stabilized and lifted by aggressive monetary policy. The Federal Reserve implemented ZIRP (zero interest rates) and Quantitative Easing in QE 1, 2, and 3, which entailed large scale asset purchases of treasuries and mortgage-backed securities, to fend off deflation and further asset price reduction.

In reflection, it has been a heck of ride lasting 9 years and 5 months, if, September 20th’s 2,930.75 closing all-time high (ATH) ends up being the top. This long-term bull has set 211 ATHs along its charge and increased in value from $6.9 trillion to $26.1 trillion. As of this writing, the present correction has erased $4.3 trillion of those gains. There have been 2,402 trading sessions throughout, 1,324 up days and 1,078 down. Positive and negative days averaged .48% and -.41%, respectively. Thursdays proved to be the most profitable day of the week to be invested, netting .089% per trading day, with Fridays bringing up the rear at .034%.

Since 1928, the month of July has rewarded broad market participants an average of 1.3%, and continued its generous manner garnering shareholders a whopping 2.8% average gain all through the ’09 bull advance; March and April, likewise, have mirrored their historical results. January, normally a positive month for stocks over the past 90 years, has been undesirable during the ’09 bull.