“To find yourself, think for yourself.”

—Socrates

2019 was the year media airways bombarded us with unrelenting negative news stories about almost everything. There were articles about the end of the world, elevated asset prices, unaffordable housing, corporate excess, federal deficits, the Mueller Report, political polarity, climate-change, trade wars, immigration gridlock, negative interest rates, the global slowdown, manufacturing contraction, and the presidential impeachment!

Dealing with the chaos 24/7 was enough to give anyone a migraine, and yet with all that uncertainty, all-knowing financial markets looked past the press morass and climbed upward and onward. Jobs, more jobs, rising wages, stable personal savings, higher home equity, increasing incomes, GDP growth, share buy-backs, easy money policies, and fiscal stimulus made up a potent cocktail that lifted wallets and spirits alike.

2019 proved to be a banner year for both risk-oriented and risk-averse investors: real estate, housing, equities, treasuries, corporate credit, municipal bonds, high yield debt, developed and emerging markets, commodities, and the U.S. dollar attained higher values. Most sectors were up double-digits for the year, led by technology, industrials, and financials. Since this bull market’s March 9, 2009 onset, the S&P 500 has been profitable 55% of all trading days. In 2019, stocks were up 60% of the time, with up days averaging .58%.

Financial gains garnered by savers and investors over this last decade has been substantial. Americans who chose to allocate money into real estate, industry-leading equities, and quality fixed income have benefitted. Baby boomers who deliberately and systematically socked away money throughout their working careers are reaping the rewards. Appreciation in personal asset values has shored up the financial position for millions of people who saved and prepared for retirement in hopes of an even brighter future. For seasoned investors and first-timers, opportunists and pragmatists, it has been one heck of a run.

Since the ending of WWII, the S&P 500 recorded a 30% total return or higher (including dividends), 12 times prior to 2019. The following year stocks continued their ascent in 10 out of the 12 instances, with 15% average gains. My friend and market historian, Chief Investment Strategist Sam Stovall, informs shareholders that during presidential election years, the S&P 500 averaged 6.3% in price gains, and posted positive returns 78% of occurrences since 1944. The past is prologue, but no one knows for sure what lies ahead.

As our nation rounds the corner on the Gregorian calendar’s 202nd decade, there are divisive issues to be deliberated, contemplated, and compromised on. Will the next 10 years be known for continued economic expansion and wealth creation, or doom and gloom? Only time will tell. I remain cautiously optimistic about world growth.

There are ample reasons to be anxious about market gyrations in the coming year. In 2020, I recommend stockholders being “in” versus “out” of the market, with a close watch on how much is “in” weighted to how much is “out.” For those desiring capital preservation, my preferences currently are intermediate-term government securities and investment-grade municipal bonds. For others seeking capital appreciation, I see value in allocating funds across a diversified portfolio of developed and emerging markets, tilted towards large-capitalization companies.

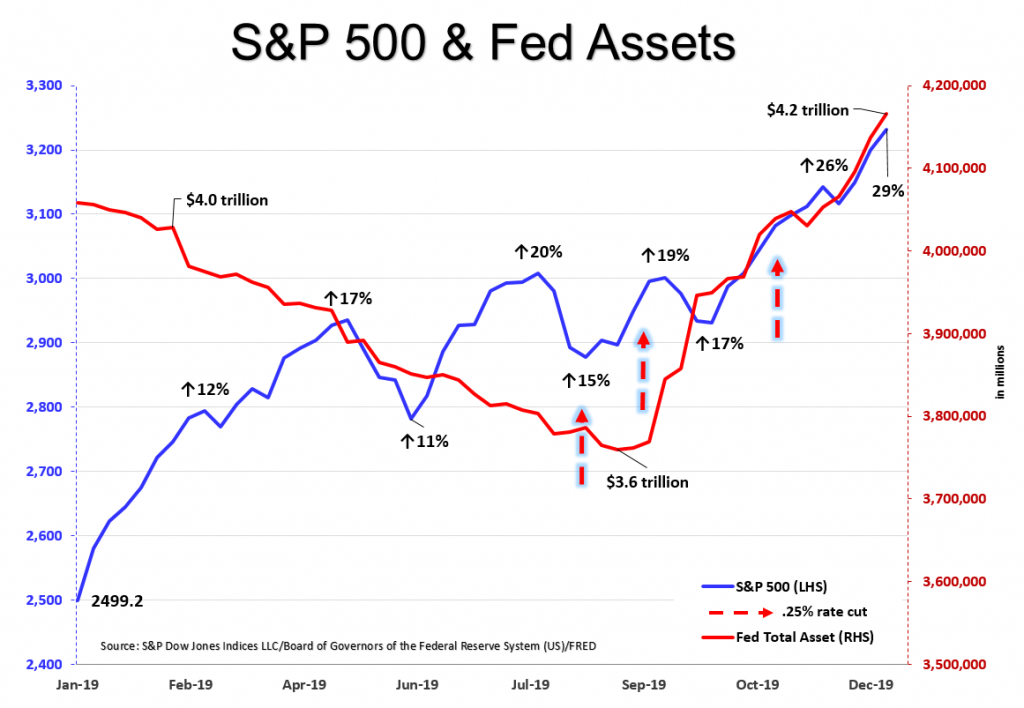

In closing, the second half of 2019 was buoyed by stimulative monetary policy, as illustrated in the graph. The S&P 500 is represented by the blue line and the Fed’s balance sheet by the red line; notice the correlation between the two. In August, September, and October, the Fed cut the fed funds rate by .25%. The Fed reduced its balance sheet from $4 trillion early in the year to $3.6 trillion by late summer. Since then, the Fed has bolstered its balance sheet by $600 billion to $4.2 trillion. Interestingly, the S&P 500 has marched in tandem. What will happen to stocks if the Fed does an about-face and decides to trim the size of its balance sheet or raise interest rates? In the months and years to come, more will be revealed.

Yours in the spirit of financial prudence,

William Corley

Important Disclosures — Any views, thoughts, and opinions pertaining to the subject matter presented in this post are solely the author’s subjective opinions and do not reflect the official policy or position of 1st Discount Brokerage, Inc. Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Any examples, outcomes, or assumptions expressed within this article are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based solely on very limited and dated open source information. Dollar-cost averaging, diversification, and rebalancing strategies do not assure a profit or protect against losses in declining markets. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses in declining markets. Assumptions made within the analysis are not reflective of 1st Discount Brokerage, Inc. nor its personnel. 1st Discount Brokerage, Inc. is a licensed FINRA broker-dealer and Registered Investment Advisor. Securities offered through 1stDiscount Brokerage, Inc., Member FINRA/SIPC.