“The name’s Branson. Sir Richard Branson. Astronaut 0 0 1. License to thrill.”

Fifteen months ago, 22.3 million Americans lost their jobs due to the pandemic. Subsequently, 15.8 million workers are back on the job, and economic growth has accelerated. These have been halcyon days for homeowners, equity holders, and high net worth individuals. In Q1-2020, the Fed cut interest rates to zero, and $8 trillion in Federal Government stimulus has been injected into the economy. The money supply has skyrocketed higher than Richard Brandson’s recent flight to outer-space.

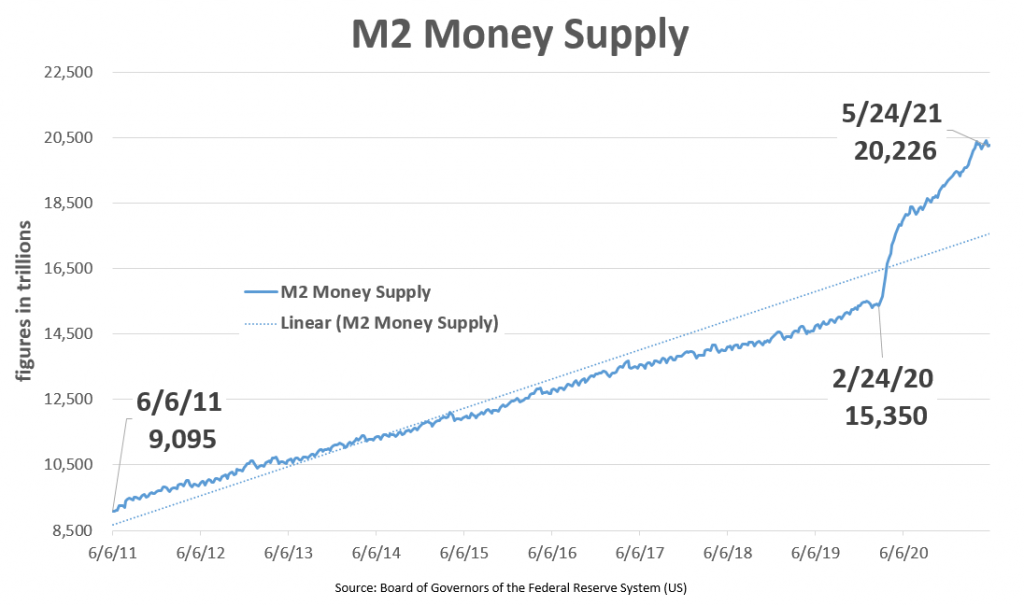

The demand for energy, commodities, used cars, and everything housing remains intact across the U.S., and animal spirits are charged to spend, invest, and make even more money. The money supply (M2), depicted in the chart above illustrates the “then and now.” In less than 12 months the total money supply of dollars in the system has increased 31%; the figure is $20.2 trillion.

Is the best yet to come, and will the temperature of this economic summer swelter get hotter, or is it time for a cool down? How should prudent investors act under such circumstances? What should they do with their investment portfolios? Will inflation erode hardworking folks and seniors on fixed-incomes purchasing power? Questions such as these are leading the headlines, mostly by fear.

Stocks have nearly doubled since the March 3, 2020 Covid-19 market bottom. The S&P 500 12-month forward price-to-earnings ratio (PE) is currently 22.7 compared to its 5-year 18.1, and 10-year 16.1 averages. Based on historical metrics the market is overpriced by 25% and 40%, respectively.

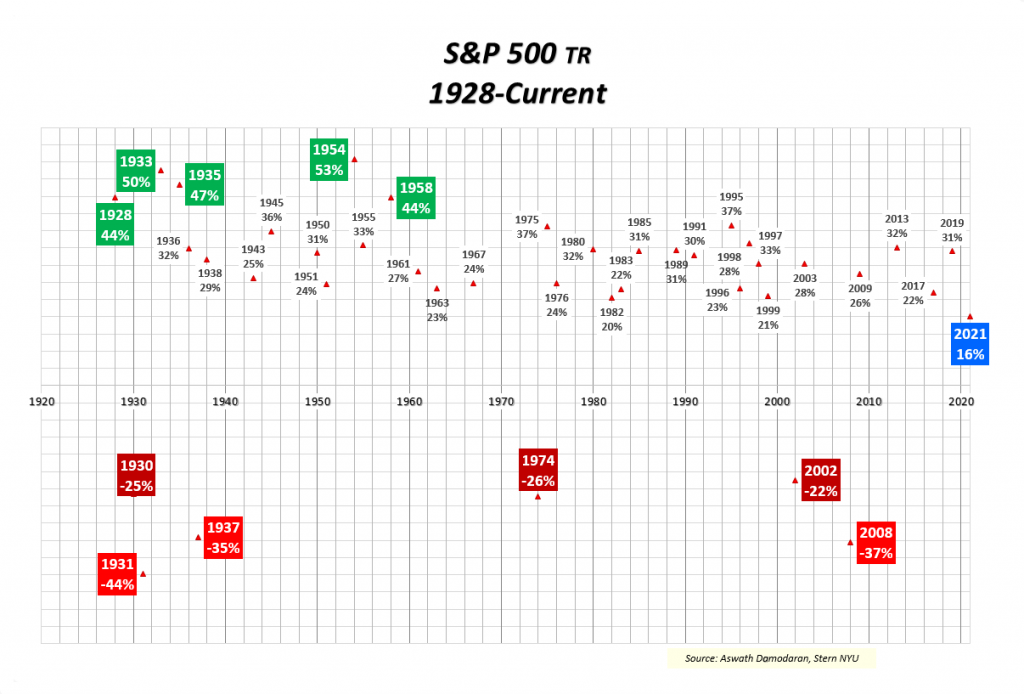

The scatter chart above posts every trading year for the S&P 500 that returned above or below 20% returns, including dividends to shareholders since 1928, a span of 93 years. The stock market returned over 20% annually or 37% of all occurrences, compared to 6% for negative results of 20% or more. Stocks rose 69 times or 74% of all years.

Interestingly, considering some folks, particularly gamblers, short-term oriented traders, and the uninformed, consider equities markets a gamble; perhaps it is their approach that is the crapshoot. Using history as our guide, it appears the odds have favored patient and prudent investors. Companies, i.e. stocks, have been valued over time based on their profits and revenues. Fundamentalists value companies based on expected future cash-flows. From the $16.95 low on February 20, 1928, until today’s $4,321 current price, stocks have multiplied 255 times, which excludes dividends; earnings per share increased by over 100 times during the past century.

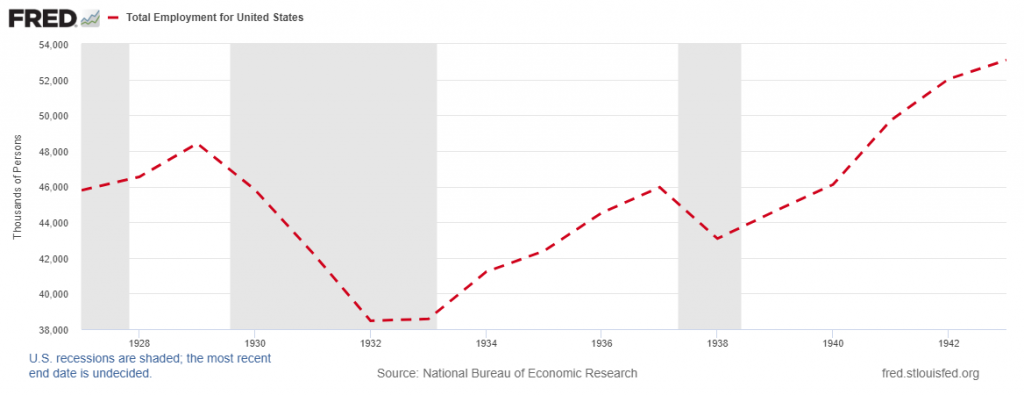

From the September 16, 1929 top at $31.86, it took 25 years for the S&P 500 to return to those levels following the Great Depression and World War. The S&P 500’s lowest close was $4.40 on June 1, 1932; that year, unemployment hit 23%, GDP contracted 13%, there were 1,700 bank closures, and our nation was punished with 11% deflation. Gross National Income was decimated, falling from $104 billion in ’29 to $57 billion three years later, a walloping 45% decrease. It was the worst of times. The Great Depression was depressing!

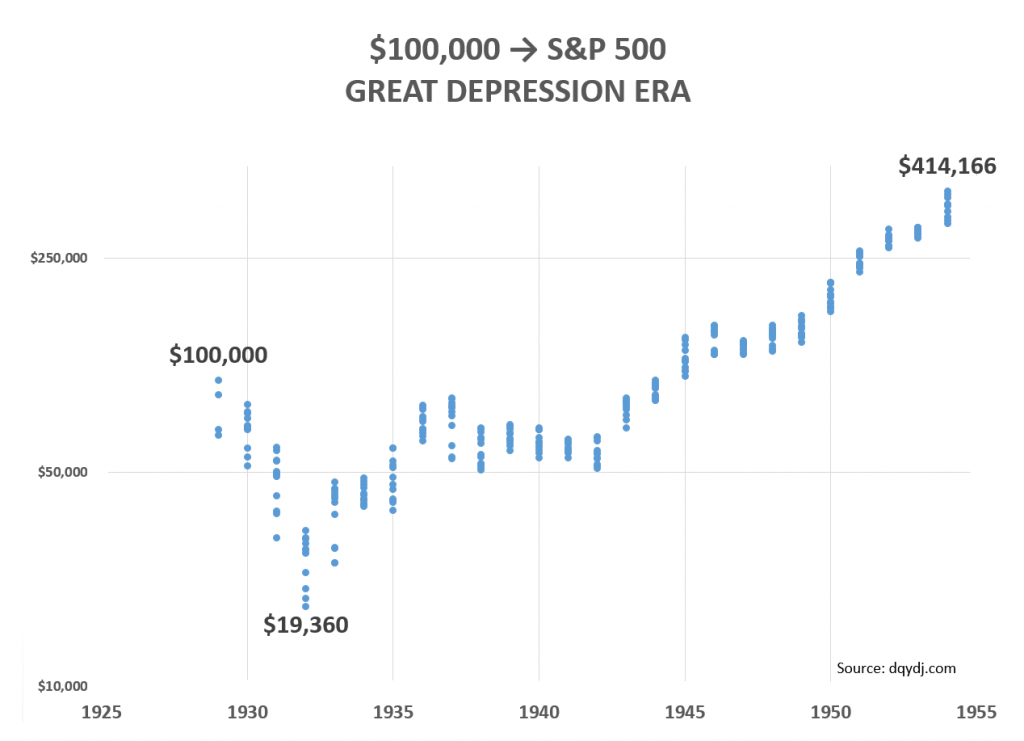

On the surface, it appears that owning equities was a losing game for the most part for a quarter-century. Was it? For patient investors, all was not lost. Hypothetically, if a forlorn sap purchased $100,000 of the index at its September 1929 high and held on for the next 25 years, their investment actually grew to approximately $414,166 (excluding costs and taxes); that’s a 5.8% annualized rate of return, according to dqydj.com. Of course, past performance is no guarantee of future results.

Loss Aversion

Would you consider risking a large sum, or all of your money on a 50:50 gamble, say on a coin flip against the casino? If so, would you take the bet, once, twice, three times, or perhaps four? What starts off as a friendly even-money fair-for-all wager, quickly turns in favor of the house the more opportunistic the gambler proceeds. The odds exponentially decrease from 50% on the first flip, to 25% on the second, and 12.5% on the third, in favor of the house. Psychological science suggests that humans as a rule are risk-averse, and perceive losses twice as negatively as they deem gains to be positive.

Professional money management has been democratized, and now, hardworking Americans, i.e. the “masses,” can have their monies invested like the “classes” for as little as $1. As Yogi Berra once said, “Times like these are here to stay until they go.”

Have a Super Summer,

William Corley

Disclosures: Any views, thoughts, and opinions pertaining to the subject matter presented in this post are solely the author’s subjective opinions, and do not reflect the official policy or position of 1st Discount Brokerage, Inc. Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Any examples, outcomes, or assumptions expressed within this article are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Dollar-cost averaging, diversification, and rebalancing strategies do not assure a profit or protect against losses in declining markets. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses in declining markets. Assumptions made within the analysis are not reflective of 1st Discount Brokerage, Inc. nor its personnel. 1st Discount Brokerage, Inc. is a licensed FINRA Broker-Dealer and Registered Investment Advisor. Securities offered through 1st Discount Brokerage, Inc., Member FINRA/SIPC.