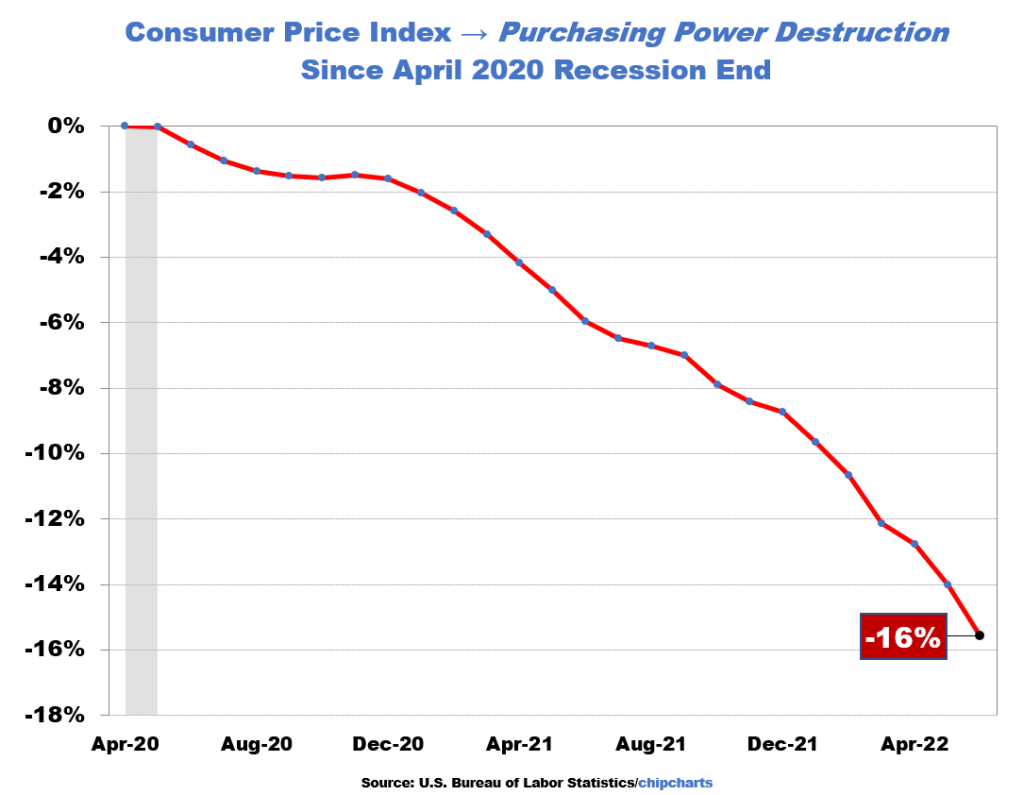

You may not hear it coming, but inflation is like a thief in the night. It sneaks up on you, gradually stealing your purchasing power away. Since the post-Covid recession, Americans have seen the value of their cash holdings adjusted for the effects of inflation decline from one dollar to .84 cents

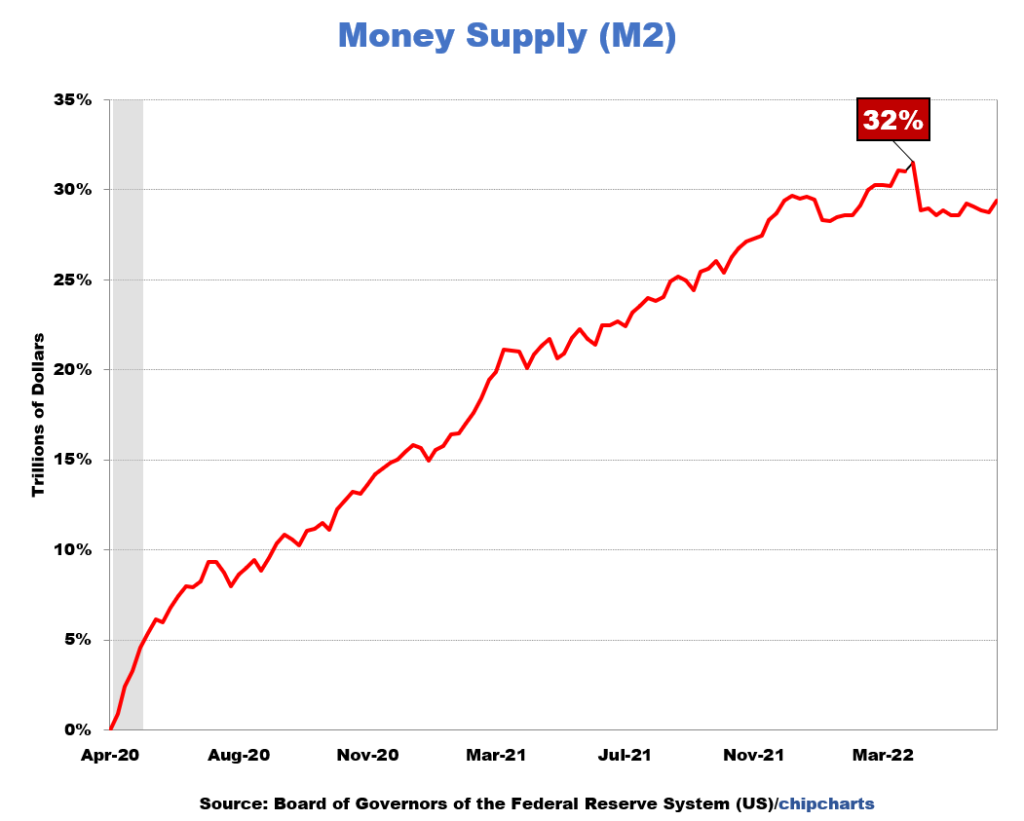

Inflation is the increase in the prices of goods and services over time. The main drivers of inflation are typically too much money (excess supply) in the economy or demand-pull (insufficient quantity) for consumption that outpaces what’s available. The Money Supply is up 30% since the recession ended.

Inflation is a scourge on the economy, and I’ve listed the culprits.

1. Excess liquidity stemming from outsized government deficit spending fueled by full-throttled monetary policy, i.e., $5 trillion in printed money. When there is more money in circulation than there are goods and services to buy, inflation is the byproduct.

2. Demand-pull inflation occurs when aggregate consumption for goods and services accelerates faster than can be produced, leading to higher prices. This can be caused by factors such as population growth, rapid economic expansion, or an increase in government spending.

3. Cost-push inflation happens when production inputs suddenly increase, leading to higher prices caused by higher energy inputs, food scarcity, and rising wages.

4. Asset inflation strikes when the values such as land, housing, or other financial assets outpace the economy. Residential home prices have skyrocketed 40% in 24 months. The wealth factor has been bolstered by what’s known as TINA (there is no alternative). The U.S. has been leading the global recovery, and King Dollar’s strength is drawing foreign investment, fostering even more investor activity.

5. Expectations-driven inflation is readily overlooked by market participants. Expectations matter significantly. Inflation expectations are self-fulfilling in that people expect prices to continue to rise in the future, so they start bidding up prices for goods and services now. Considering that today’s dollars may be worth less in real terms in the future expedites the expectations narrative to spend now to save later.

What Federal Reserve Inflation Indicators Mean for the Economy

There are a variety of inflation indicators that central banks and economists use to measure and predict future inflationary trends. Some common indicators include the employment cost index, gross domestic product deflator, and producer price index.

The employment cost index measures how much wages and benefits rise within an economy. It is watched closely by central banks because rising wages can lead to inflationary pressures.

The gross domestic product deflator measures inflation in the overall economy and considers changes in the prices of all goods and services produced within the economy.

The producer price index is a measure of inflation at the wholesale level, and it tracks changes in the prices that producers receive for their goods and services.

Each of these indicators can give important clues about future inflationary trends. Central banks use them to make decisions about monetary policy, such as interest rate changes. Investors also watch these indicators closely, as they can impact financial markets.

“Inflation is always and everywhere a monetary phenomenon.”

—Milton Friedman, Nobel Prize in Economics

William Corley

Professional Money Manager

Disclosure: any views, thoughts, and opinions pertaining to the subject matter presented in this post are solely the author’s subjective opinions and do not reflect the official policy or position of 1st Discount Brokerage, Inc. Information is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Past performance is no guarantee of future results. Any examples, outcomes, or assumptions expressed within this article are only hypothetical illustrations and should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Dollar-cost averaging, diversification, and rebalancing strategies do not assure a profit or protect against losses in declining markets. Asset allocation and investment losses. Assumptions made within the analysis are not reflective of 1st Discount Brokerage, Inc. nor its personnel.

1st Discount Brokerage, Inc. is a licensed FINRA Broker-Dealer and Registered Investment Advisor.

Securities and services are offered through 1st Discount Brokerage, Inc., Member FINRA/SIPC.